If you were to be unfortunate adequate to have a mishap where you required to assert on your insurance, your benefit would certainly be decreased or totally reduced depending on how long your NCB is (accident). In the event of a claim, your no claims incentive will certainly be lowered by two years as you can see in the table * listed below: * numbers revealed may not be depictive of all insurance companies' conduct (insure).

auto risks risks low cost

auto risks risks low cost

The amount you'll spend for automobile insurance policy is impacted by a variety of really various factorsfrom the type of insurance coverage you have to your driving document to where you park your automobile. While not all firms use the same criteria, right here's a list of what generally figures out the bottom line on your vehicle policy.

If you've had accidents or significant web traffic offenses, it's likely you'll pay more than if you have a tidy driving document. You might likewise pay even more if you're a brand-new driver without an insurance policy record. vehicle. The even more miles you drive, the more possibility for mishaps so you'll pay more if you drive your car for job, or use it to commute fars away.

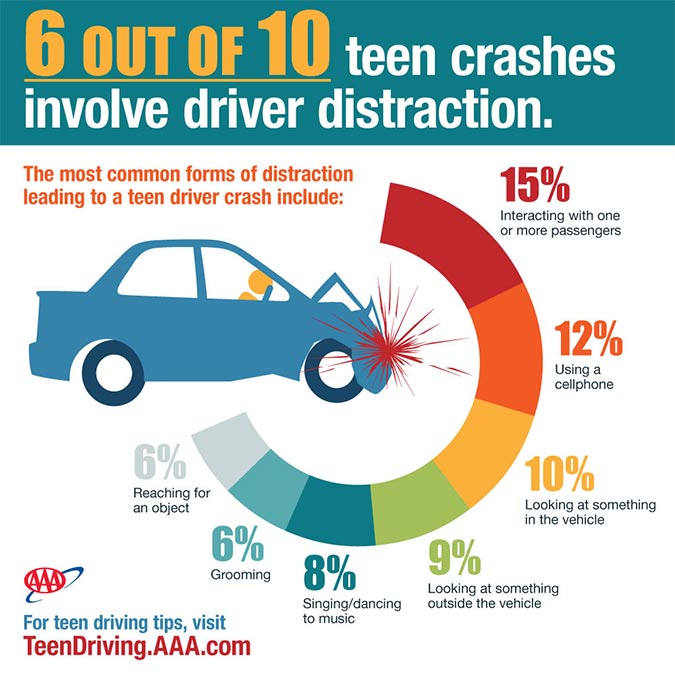

Insurance companies typically charge much more if teenagers or youngsters below age 25 drive your automobile. Statistically, ladies often tend to enter less accidents, have less driver-under-the-influence crashes (Drunk drivings) andmost importantlyhave less major crashes than males. All various other things being equivalent, females usually pay less for auto insurance than their male counterparts (car insurance).

Comparable to your credit history, your credit-based insurance coverage score is a statistical device that anticipates the possibility of your submitting an insurance claim and the likely cost of that claim. The limitations on your standard auto insurance coverage, the amount of your deductible, and the kinds and amounts of plan choices (such as collision) that are prudent for you to have all impact just how much you'll pay for protection (perks).

Top Guidelines Of Finding The Cheapest Car Insurance For Teens - Usnews.com

business insurance car low cost auto insured car

business insurance car low cost auto insured car

Cars and truck insurance policy is required to protect you financially when behind the wheel (insurance company).!? Right here are 15 strategies for saving on vehicle insurance policy costs.

Reduced automobile insurance prices might additionally be offered if you have various other insurance policies with the same business (credit). Car insurance prices are various for every chauffeur, depending on the state they live in, their option of insurance coverage company and the type of coverage they have.

The numbers are rather close with each other, recommending that as you budget plan for a brand-new vehicle acquisition you may need to include $100 approximately monthly for automobile insurance (cheap car). Keep in mind While some points that affect vehicle insurance coverage prices-- such as your driving background-- are within your control others, expenses might additionally be affected by things like state laws and also state mishap rates - cheap.

vehicle accident insurance companies trucks

vehicle accident insurance companies trucks

As soon as you recognize just how much is cars and truck insurance coverage for you, you can put some or all of these tactics t work (insurance companies). 1. Capitalize On Multi-Car Discounts If you get a quote from a car insurance provider to guarantee a solitary car, you could wind up with a higher quote per automobile than if you asked about guaranteeing a number of motorists Click to find out more or automobiles with that firm.

If your youngster's qualities are a B standard or over or if they rate in the top 20% of the course, you might be able to get a excellent student discount rate on the insurance coverage, which typically lasts till your child transforms 25. These price cuts can vary from just 1% to as long as 39%, so be certain to reveal proof to your insurance policy representative that your teenager is a good pupil.

Some Known Details About Tips For First-time Car Insurance Buyers - Forbes

vans insured car cheap auto insurance vehicle insurance

vans insured car cheap auto insurance vehicle insurance

Allstate, for example, provides a 10% car insurance coverage discount and a 25% house owners insurance policy discount when you bundle them together, so inspect to see if such discounts are offered as well as applicable - affordable car insurance. Pay Attention on the Roadway In various other words, be a risk-free chauffeur.

Travelers offers safe vehicle driver discounts of between 10% and also 23%, depending on your driving record. For those unaware, points are normally assessed to a chauffeur for moving infractions, and also extra factors can lead to higher insurance policy costs (all else being equal) (insurance companies).

Make certain to ask your agent/insurance company regarding this discount before you register for a course. It's important that the initiative being used up and also the expense of the course equate into a huge enough insurance policy savings. It's likewise crucial that the driver sign up for a certified course.